Did you know?

Did you know?

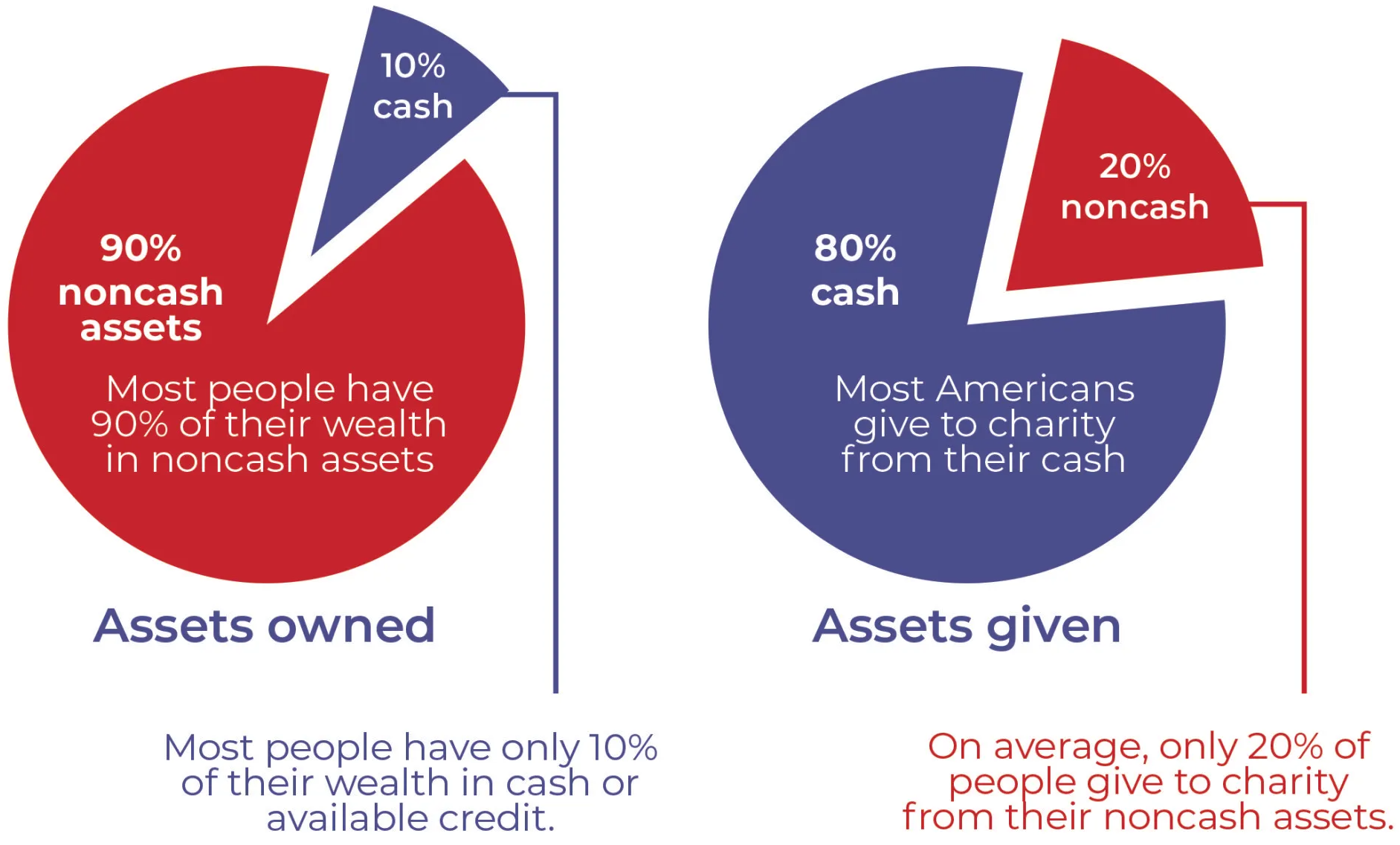

Many people think that in order to give more to charity, you have to cut into your personal lifestyle expenses. But, there's another way!

SAFE donors can multiply their impact: asset-based giving, or sometimes called planning giving because this type of giving takes a little planning, but can reap big rewards.

By donating non-cash assets such as stocks, real estate, personal property, or business interests before the sale, donors can reduce taxes and send more to the work of SAFE than they ever thought possible.

Planned gifts, especially bequests, are a great way to build your family's legacy and change the lives of others for generations to come.

BENEFITS OF GIVING MORE WISELY

Less to Taxes

Less to Taxes

By donating non-cash assets first (rather than selling them first, paying taxes, and then giving the net proceeds) you typically receive a tax deduction for the full-fair-market value of your gift, as well as avoid capital gains taxes.

More to SAFE

More to SAFE

The capital gains taxes you save from giving the asset directly to SAFE means more goes to support the great work SAFE is doing.

Personal Savings

Personal Savings

Because you typically receive the full tax deduction for the fair-market value of the asset, you may see great savings on your personal income tax returns. This means more money stays in your pocket for your lifestyle expenses or additional giving.

The SAFE Alliance exists to stop abuse for everyone by serving the survivors of child abuse, sexual assault, trafficking, and domestic violence.

Need Help?

24/7 SAFEline

Call:

512.267.SAFE (7233)

Text: 737.888.7233

Chat:

CLICK HERE

For Deaf, DeafBlind, DeafDisabled, and Hard of Hearing people:

please use relay/VRS

Address

The SAFE Alliance

P.O. Box 19454, Austin, TX 78760

Join our newsletter and learn more

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

© 2024

The SAFE Alliance ALL Rights Reserved. | Privacy Policy